With the end of last year, Daimler stopped selling its flagship vehicle, Maybach. I would like to use this opportunity to talk about the danger and harm to your company by increasing the number of product types sold. As an illustrative (and expensive) example, I would like to split the total cost of the Maybach in its individual parts (as far as I can estimate them). My hope is that this motivates you to reduce, or at least no longer increase, the number of variants in your product portfolio.

The Maybach Story

Maybach was a German luxury car maker. Operations started in 1909, and the last passenger car was built in 1940. In 1997, Daimler announced the revival of the Maybach brand, last built in 1940. The goal was to build a top-of-the-line luxury car that had no equals. Money was no object. This was just one of many bad decisions by then Daimler CEO Jürgen Schrempp (also responsible for the disastrous “Marriage in Heaven” with Chrysler). In any case, whenever money is no object, it will become expensive.

Maybach was a German luxury car maker. Operations started in 1909, and the last passenger car was built in 1940. In 1997, Daimler announced the revival of the Maybach brand, last built in 1940. The goal was to build a top-of-the-line luxury car that had no equals. Money was no object. This was just one of many bad decisions by then Daimler CEO Jürgen Schrempp (also responsible for the disastrous “Marriage in Heaven” with Chrysler). In any case, whenever money is no object, it will become expensive.

The base price of the cheapest Maybach was around $350,000, but additional options could easily multiply the price. The average sales price of every unit was probably at least $500,000. Sales were optimistically expected to be around 2,000 units per year. In reality, however, this was highly overestimated, and only a few hundred vehicles were sold worldwide per year.

Additionally, there were many different Maybach models available, splitting the low sales number over different versions. Additional options were, of course, available. For cars in this price range, the question is not so much what options the maker offers, but what extras the customer wants. Examples included mini fridges for champagne, real granite interior, and air-conditioned seats. Here’s a list of Maybach models sold:

- Maybach 57 – 570 cm long

- Maybach 57 S – S for Spezial, having, for example, more engine power and a different suspension among other things

- Maybach 57 S Coupé – two door version

- Maybach 62 – 620 cm long

- Maybach 62 S – S for Spezial, having, for example, more engine power and a different suspension among other things

- Maybach Zeppelin – limited edition, more powerful engine, also available in 570- and 620-cm length

- Maybach Landaulet – sliding convertible roof for rear seats

- Maybach Exelero – designed for speed exceeding 350 km/h (initially considered a prototype, but a few units sold at about $8 million per vehicle)

- Maybach Guard – armored version for high-profile customers

Overall, the venture was a financial disaster. With every car sold, Daimler lost $439,000, or about $1.3 billion in total. In 2013, Daimer CEO Dieter Zetsche finally pulled the plug. Overall, between 1997 and 2013, only 3,000 units were sold, less than 200 per year. The primary reason for this financial disaster was too-low sales for too many different variants. Hence the fixed costs killed any chance of profit.

The Largest Cost Factors

Development

Cost of complexity starts with development. Every new product has to be developed, including all necessary components. With cars, it is said that development of a new car will cost between $1 billion and $2 billion. With Maybach, I took a conservative estimate of $1 billion development cost for all variants combined. This does not include, for example, tooling and paperwork below which may have been included in the development cost. Overall, the $1 billion development cost spread over 3,000 cars over lifetime added around $330,000 to each and every car.

Cost of complexity starts with development. Every new product has to be developed, including all necessary components. With cars, it is said that development of a new car will cost between $1 billion and $2 billion. With Maybach, I took a conservative estimate of $1 billion development cost for all variants combined. This does not include, for example, tooling and paperwork below which may have been included in the development cost. Overall, the $1 billion development cost spread over 3,000 cars over lifetime added around $330,000 to each and every car.

Tooling

To produce, you need tools. Depending on your business, these tools may be expensive. If you are making cars, say, for example, a Maybach, you need lots of tools. Especially, the tools for the sheet metal presses are insanely expensive, as are the tools for injection-molded parts. You also may occur additional costs by changing tools or scrapping tools due to design changes or manufacturing problems.

To produce, you need tools. Depending on your business, these tools may be expensive. If you are making cars, say, for example, a Maybach, you need lots of tools. Especially, the tools for the sheet metal presses are insanely expensive, as are the tools for injection-molded parts. You also may occur additional costs by changing tools or scrapping tools due to design changes or manufacturing problems.

For Maybach, I estimate that they paid around $300 million in tooling cost, adding another $100,000 to every car sold.

Paperwork

Do not underestimate the importance of paperwork! It is said that in the car industry, a single part number over its lifetime will cause costs of around $50,000 simply for the paperwork. The number has to be created, the documentation filed, updated, maintained, updated again for changes in the system, documented, etc. It is easy to see that this may cost $50,000 for a single number.

Do not underestimate the importance of paperwork! It is said that in the car industry, a single part number over its lifetime will cause costs of around $50,000 simply for the paperwork. The number has to be created, the documentation filed, updated, maintained, updated again for changes in the system, documented, etc. It is easy to see that this may cost $50,000 for a single number.

It is said that around 30,000 part numbers are needed to produce a single car. As for Maybach, I assume (hope!) that they utilized many parts from other vehicles. Nevertheless, I estimate that around 8,000 parts may have been created for the different Maybach versions. Hence, in sum this created additional costs of around $400 million merely for the paperwork, or another $130,000 per car!

Granted, car manufacturers have higher requirements on documentation than most other industries. Nevertheless, even in less complex technical industries you can expect paperwork cost of around $10,000 for every individual part number.

Raw Material and Finished Goods Inventory

To make cars, you need parts. While there is lots of talk about Just-in-Time deliveries with low inventory, most Western car makers still have weeks’ worth of inventory in a single plant and months’ worth of inventory in their supply chain.

To make cars, you need parts. While there is lots of talk about Just-in-Time deliveries with low inventory, most Western car makers still have weeks’ worth of inventory in a single plant and months’ worth of inventory in their supply chain.

Unfortunately, the fewer products you sell, the higher your inventory becomes per unit sold. Take, for example, finished goods. If you want to have your product in stock and readily available, you need at a very minimum one part in stock. Now, if you sell one part per year or ten thousand per year, the cost of your inventory as a part of the unit cost goes up.

Granted, if you sell more parts, you need more inventory for a good availability, but the inventory increases much more slowly than the number of parts sold. Overall, the more you sell of one product, the less inventory you need per unit sold.

With Maybach, sales were abysmal. Making another (very!) conservative estimate, I believe they had at least four months’ worth of inventory and finished goods in the supply chain. Estimating $500,000 per car for an average of 187 cars sold per year, four months of inventory represents $30 million of tied-up cash. In traditional bookkeeping, this is now multiplied by the cost of capital (sort of the interest rate for borrowing $30 million to put them on the shelf), usually on the magnitude of 10%–15%.

However, this traditional cost of capital does not include the handling cost, storage cost, logistics operation, and organizational effort. It does not include the cost of defective goods, aged products, or goods damaged while handling. Overall, I believe the cost of having inventory is closer to 25% of the value of the inventory per year. Hence, $30 million of Maybach inventory would create expenses of around $8 million per year, or around $41,000 per vehicle for only its inventory. On the other hand, $41,000 per vehicle is small fry compared to the other expenses 🙁 .

Manufacturing

Let’s not forget, you also have to actually produce the vehicle. Again, taking general industry knowledge, the actual production cost including raw materials, labor, energy, and so on is around half of the retail car price. As for the Maybach, the actual cost of production may therefore have been around $250,000 per vehicle.

Let’s not forget, you also have to actually produce the vehicle. Again, taking general industry knowledge, the actual production cost including raw materials, labor, energy, and so on is around half of the retail car price. As for the Maybach, the actual cost of production may therefore have been around $250,000 per vehicle.

Of course, due to the low quantities produced, Maybach was anything but an automated line. The car was probably mostly handmade wherever possible. The ideal condition for manufacturing is to make lots of units of a single part. The more you increase your variety, the more effort is needed to switch between products, train workers, shift around raw materials, and so on. In that aspect, Maybach was probably a very inefficient production.

Sales

You also need to sell the product. With manufacturing, the more units you sell of the same product, the cheaper your sales cost will be. In automotive, a common estimate is to assume sales as 25% of the total sale price, including advertising, show rooms, and so on.

You also need to sell the product. With manufacturing, the more units you sell of the same product, the cheaper your sales cost will be. In automotive, a common estimate is to assume sales as 25% of the total sale price, including advertising, show rooms, and so on.

With Maybach, again the 25% is probably a conservative estimate. In Daimler’s view, the Maybach was too good for a common Mercedes showroom, so new, exclusive showrooms for the Maybach were built. Considering the total number of sales, these rooms were probably not too busy.

In any case, assuming 25% of the vehicle price for sales gives sales cost of about $125,000 per car or $375 million over lifespan.

Spare Parts and End-of-Life Ramp Down

Finally, last year in 2013, Daimler pulled the plug and stopped the sales of Maybach. Unfortunately for them, they have to provide spare parts for at least another ten years! This is a major drag on resources for a company. Usually there are two options:

Finally, last year in 2013, Daimler pulled the plug and stopped the sales of Maybach. Unfortunately for them, they have to provide spare parts for at least another ten years! This is a major drag on resources for a company. Usually there are two options:

Option 1: Keep on manufacturing parts. This is unpleasant and expensive. The machines and tools were usually designed for much larger quantities. Running them for a few hours every year is quite a waste of resources. They have to be maintained, set up, the workers have to be trained, the material suppliers have to be kept active, quality control has to maintain the standards, and so on. Alternatively, you can spend even more money on downsizing the tools and machines, which is also quite a drag.

Option 2: Put enough spare parts in stock to last for ten years. Naturally, this is also an unpleasant option, as it ties up lots of capital, not to mention the storing, handling, and organizational expenses. There is the additional risk that parts may become defective. Or you may run out of parts before the ten years are over. Or you may have too many parts left after ten years, which you now can throw away. In any case, not a good option either.

In reality, most manufacturers try to compromise by producing for a few years before creating a stockpile for the remaining time and scrapping the old tools. Maybach will probably have to stock spare parts for the next ten years, long after production ceased. It is hard to estimate the cost of these spare parts, but it is again not to be underestimated.

Wrap Up

Overall, the Maybach venture was a huge loss for Daimler. Honestly, this was already pretty clear to me (and many others) when Daimler started to produce Maybachs. Yet, it seems business rationale went out of the window in favor of gearheads wanting to build the perfect car.To me it seemed like the former CEO, Mr. Schrempp, treated Daimler as his personal toy box to build himself a dream car. When cost calculations did not add up, sales numbers were probably adjusted upward, and additional fuzzy factors like “good for the brand image” added. Luckily, current CEO Mr. Zetsche finally pulled the plug on this crazy venture.

According to official numbers, Daimler lost about $1.3 billion. However, as this is very embarrassing for Daimler, I suspect that the official numbers are only the bare bones. There are probably many more losses related to Maybach that are accounted for somewhere else to make the officially reported losses smaller. The true losses may much higher, and I wouldn’t be surprised if they exceeded $2 billion.

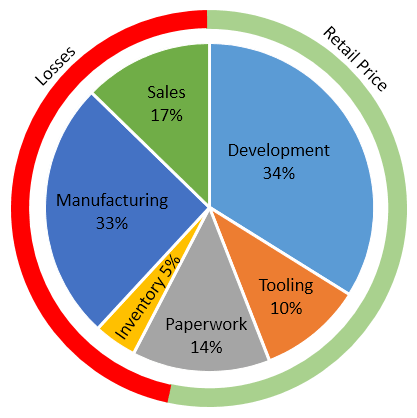

The graph below shows an estimate of the costs of a car averaged throughout the production run between 1997 and 2013 (but not accounting for inflation). Please keep in mind that many of these numbers are my rough by-the-seat-of-your-pants estimations and not official Daimler data.

The main problem is the low number of units sold. The first three major cost-drivers – development, tooling, and paperwork – make up more than half the total cost. Yet these three are all more-or-less fixed costs. The cost is split evenly over the number of cars sold. Hence the more cars sold, the smaller the cost per car – so, as in Daimler’s case, the less cars sold, the higher the cost.

The second three points – inventory, manufacturing, and sales – are traditionally variable costs (i.e., assumed to be the same on a per car basis). However, even there, larger numbers will reduce the costs, albeit less than for variable costs. Overall, Maybach was killed by its small numbers. According to my numbers, they would probably have to sell seven times as many vehicles just to barely break even. Please also note the large share of expenses for paperwork!

However, similar things happen every day in industry, except that the exotic product is not killed but kept in the portfolio. I have seen many companies where, on a smaller scale, complexity escalated and the number of product types multiplied while the total units sold did not change much. As an effect, cost went up and times got tougher for the companies.

If there is anything I want you to take with you after reading this (rather long) post, it is: Try to keep your number of product types under control, or even reduce them if possible! The cost associated with dividing the same number of units sold on more product types is significant!

I hope this was interesting for you. Now go out and improve your industry!

Same Story, different Maker…

Other car makers are not immune either to such expensive toys that please mostly management . The Volkswagen version of such a toy is the 1200 horsepower Bugatti Veyron. At a cost of at least €1.69 million only 425 vehicles (if you can call them that) have been sold. Production is stopping, and the last 25 vehicles on stock will be sold in the next few months. The total loss for VW is estimated to be €1.7 billion, even more than for the Maybach. Also akin to the Maybach, the large development cost plus the number of special options killed any chance of profitability. In any case, VW chairman Ferdinand Piëch surely must have gotten his excitement out of this automotive wet dream. However, it seems VW is a slower learner than Daimler, as VW is considering an even bigger successor for the Veyron. I strongly believe that this successor will turn out to be a similar financial disaster in the billion-euro range.