“Make or buy?” is a question most companies have to ask themselves. Which parts or even products should you make yourself, and which ones should you outsource to a third-party supplier? The question itself is already difficult, but here again we run into the problem of cost accounting. If you go purely by the numbers, you can easily run your company into the ground. Let me show you how (NOT) to do it.

“Make or buy?” is a question most companies have to ask themselves. Which parts or even products should you make yourself, and which ones should you outsource to a third-party supplier? The question itself is already difficult, but here again we run into the problem of cost accounting. If you go purely by the numbers, you can easily run your company into the ground. Let me show you how (NOT) to do it.

Introduction

It is rare that a company makes all items that it produces itself. Such a full vertical integration would include everything from the mine for the materials to the final product to the customer. Henry Ford tried it, and even bought a gigantic rubber plantation in Brazil, but he failed miserably. More common are companies that do not produce anything themselves. Apple, for example, creates the design but outsources all production to suppliers. However, the vast majorities of companies with a physical product lie somewhere between these extremes. Toyota, for example, reportedly creates 30% of the value in-house and purchases the rest.

How to (Supposedly) Decide on Make-or-Buy

One popular way to decide if a company makes a part themselves or lets someone else make them is by the cost. If the supplier is cheaper, then the supplier should get the business. You simply ask suppliers for quotes, and if they are better than the in-house cost calculation, you give them the business. And here again, we run into a frequent nemesis for lean manufacturing: cost accounting. They determine the cost of the production in-house, which is then compared with the cost from the supplier. These two numbers are (often) everything you (supposedly) need to decide.

One popular way to decide if a company makes a part themselves or lets someone else make them is by the cost. If the supplier is cheaper, then the supplier should get the business. You simply ask suppliers for quotes, and if they are better than the in-house cost calculation, you give them the business. And here again, we run into a frequent nemesis for lean manufacturing: cost accounting. They determine the cost of the production in-house, which is then compared with the cost from the supplier. These two numbers are (often) everything you (supposedly) need to decide.

A Fictitious Example

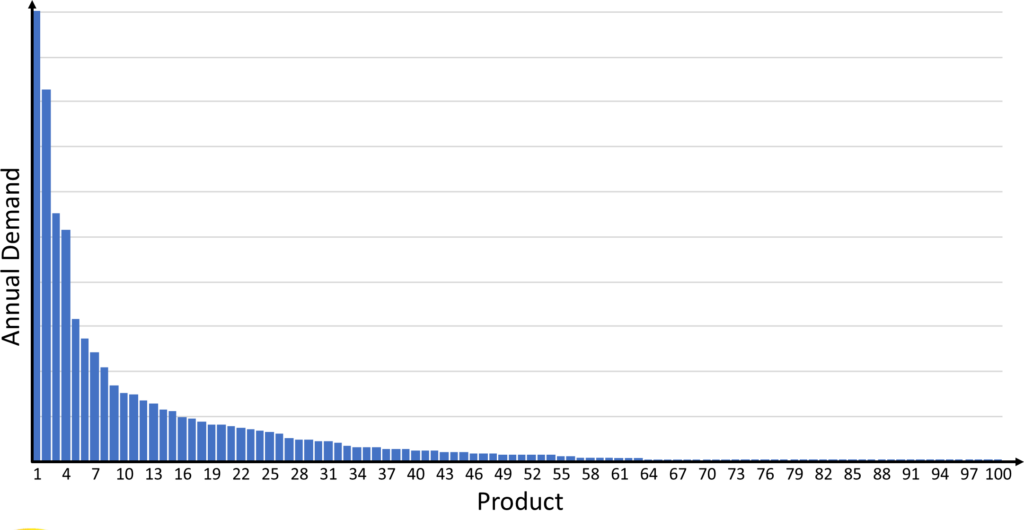

Let’s take an example. You make a product for which you need sheet metal parts. One hundred different sheet metal parts, to be precise. You currently make all of them in-house. Now you conduct a make-or-buy analysis based on the cost, comparing the best supplier offer with your cost calculation prices. Below is a (fictional) Pareto chart with the annual demand of all of your one hundred products, from the high-runner to the exotics that are produced once per year or even less.

You conduct a make-or-buy analysis for all one hundred sheet metal parts. For the sake of the argument, assume you get bids from suppliers for all one hundred parts (even though in reality you would probably not get them for all). While in reality the results may vary somewhat, my guess would be that the decision to make or buy would something like the graph below.

You conduct a make-or-buy analysis for all one hundred sheet metal parts. For the sake of the argument, assume you get bids from suppliers for all one hundred parts (even though in reality you would probably not get them for all). While in reality the results may vary somewhat, my guess would be that the decision to make or buy would something like the graph below.

If you have experience in industry, you probably can already smell where my argument is going. All your high-runner A-parts get offers that are cheaper than your own (supposed) production cost, whereas most of your B-parts and probably all of your exotic C-parts are supposedly cheaper to make in-house. You would have never guessed that the expertise in your company is to make cheap exotic C-parts, right? Well, it isn’t!

Why This Is Dangerous

Unsurprisingly, suppliers like to produce large quantities. They usually have little interest in the random assortment of C-parts that are rarely needed but still crucial for your company to function. This is because they know that production is subject to the economy of scale, and producing larger quantities is much more efficient than smaller ones. Even if they offer a bid on C-parts, its prices will be significantly higher per part than for the A-parts. As a result, you may hand them the A-parts and keep the C-parts.

Unsurprisingly, suppliers like to produce large quantities. They usually have little interest in the random assortment of C-parts that are rarely needed but still crucial for your company to function. This is because they know that production is subject to the economy of scale, and producing larger quantities is much more efficient than smaller ones. Even if they offer a bid on C-parts, its prices will be significantly higher per part than for the A-parts. As a result, you may hand them the A-parts and keep the C-parts.

But in this case (as all so often in lean), the cost calculation does not fully reflect the real situation. In all likelihood, the high-volume A-parts are actually cheaper than the calculation, and the exotic C-parts are probably more expensive than the calculation, maybe even turning a loss. This is due to the difficulty of cost accounting to measure the financial impact of fluctuations. I don’t blame cost accounting for that, as long as they realize that the costs are there. In fact, the fluctuations and the costs associated with it can even increase.

If you produce components or products in-house, how often does it happen that due to a mix-up, change in demand, or other event you quickly need a part to prevent a (minor or major) crisis? If it is in-house, you have full control over production and can just re-prioritize production to better match the changed needs. Sure, it won’t be easy, but it will help to keep the system running.

However, this is completely different for external suppliers. You have no control over their production, and your priority may be quite different from their priority. You may not even be a major customer for them. Hence, the urgent rush order may or may not be treated as urgently as you would like. Even if it is produced swiftly, you still have to ship it to your own plant. If you are in the USA or Europe and the supplier sits in Southeast Asia, you either have to wait a few months for the ship to arrive or pay expensive air freight—and still wait two weeks for shipping and customs. All of this creates cost that is nowhere included in the calculations.

Similarly, any quality issue can be resolved much quicker in-house. It will take more time if you need to communicate with an external supplier to find the cause of the defect, resolve the issue, and take care of all the potentially defective goods in the supply chain—and this is assuming that the supplier takes responsibility and does not blame the customer or someone else.

Additionally, cost accounting attributes the fixed cost like machines and tools to all parts produced. But if you give the high-runners away, the fixed cost increases and your exotics become even more expensive. You outsource the variable cost and keep (a lot of) the fixed cost.

If you outsource the A-parts, you keep all the stuff that is much more expensive to make than you think. Most companies have a mixture of profitable high-runners and loss-making exotics, and you are outsourcing the profitable parts (for someone else’s profit) and keeping the loss-makers (for your own losses). Overall, if you decide make-or-buy purely by comparing the cost calculations with the supplier bids, you are likely to keep the actually expensive parts while outsourcing the actually profitable parts, and that is not good.

Of course, there are good reasons to outsource and buy parts or products, but this is not only a decision of finances. More on this in my next post. Now, go out, think carefully before outsourcing a high runner, and organize your industry!

PS: This post was inspired by a very fruitful discussion with Karl-Ludwig Blocher.

The fictitious example is absolutely tru. as a manufacturing manager I often was advised to purchase the high volume types and keep the low volume ones, since the calculations showed that the profit would increase. Due to the reasons that you present I refused.

It was actually possible to show that a lot of cost would remain and would be put on the low volume types.

A “better” way to show that you need to out-source in-house production is decide if it is your core competence or not. If it’s not, out-source, but then 100 % of the volume. Then when you need to invest use the money to improve knowledge/cost where you have your core competence.