The largest ten car makers sell over 200 different car models on the US market. Without vans, SUVs, and sport cars, there are still 100 consumer cars left. Toyota has the largest number with a total of 14 models, yet they still have an excellent market strategy and very little self cannibalization. BMW has much fewer models, yet still manages to cannibalize itself. GM has 13 models and also steps on its own toes, while completely missing another market segment. This post is based on a master’s thesis of one of my students, Amir Javanshir, and the detailed source is at the end of the article.

The largest ten car makers sell over 200 different car models on the US market. Without vans, SUVs, and sport cars, there are still 100 consumer cars left. Toyota has the largest number with a total of 14 models, yet they still have an excellent market strategy and very little self cannibalization. BMW has much fewer models, yet still manages to cannibalize itself. GM has 13 models and also steps on its own toes, while completely missing another market segment. This post is based on a master’s thesis of one of my students, Amir Javanshir, and the detailed source is at the end of the article.

About the Data Source

Mr. Javanshir collected tons of data of the available models on the US automotive market. He compared the price with a technical index consisting of the width, length, and height, and the weight, displacement, and power output. Each of these indices was normalized between 0 and 1, i.e. the car with the smallest length got an index for the length of 0, and the longest car got the index 1. All other cars were distributed between 0 and 1 proportionally to their length. The tech index is constructed from the following variables.

- Size index, consisting of

- Width (excluding mirrors): Smart 1.56m to Audi A8 1.95m

- Length: Smart 2.69m to Daimler S Class 5.25m

- Height: Audi A5 1.37m to Fiat 500l 1.67m

- Engine index, consisting of

- Displacement: BMW i3 0.7l to Chevrolet SS 6.2l

- Power output: Toyota Prius 73PS to Daimler S Class 449ps

- Weight: Smart 880kg to Daimler S Class 2145kg

The indexed width, height, and length were multiplied in a size index. The indexed displacement and power output were multiplied in a engine index. Finally, the size index, the engine index, and the weight were multiplied in a technical index, ranging from the smart at 0.075 to the Daimler S class at 0.871. A total of 100 vehicles have been included in the analysis. The makers and brands are listed below. The data is from the beginning of 2015.

- US makers

- General Motors: Buick, Cadillac, Chevrolet

- Ford Motor Company: Ford, Lincoln

- Chrysler Group: Chrysler, Dodge, Fiat

- Japanese Makers

- Toyota Motor Corporation: Lexus, Scion, Toyota

- Nissan Motor Company: Infiniti, Nissan

- Honda Motor Company: Acura, Honda

- German makers

- Volkswagen Group: Audi, Porsche, VW (not including ultra-luxury Bentley and Lamborghini)

- Daimler: Mercedes-Benz, Smart

- BMW Group: BMW, Mini (not including the ultra-luxury group Rolls Royce)

- South Korean Makers

- Hyundai-Kia Autom. Group: Hyundai, Kia

The Clustering

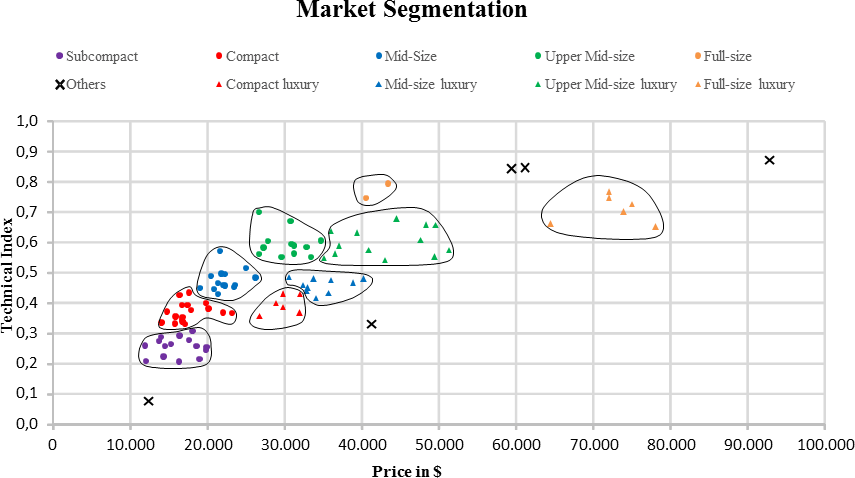

Using some clustering analysis tools and some manual optimization generated nine different classes of cars. Interestingly enough, almost all classes were doubled. For each “normal” car segment except subcompact, there was a corresponding luxury segment. Similar specs, but fancier and hence a higher price. The overall segmentation is shown below, including some cars that where outside of any segmentation.

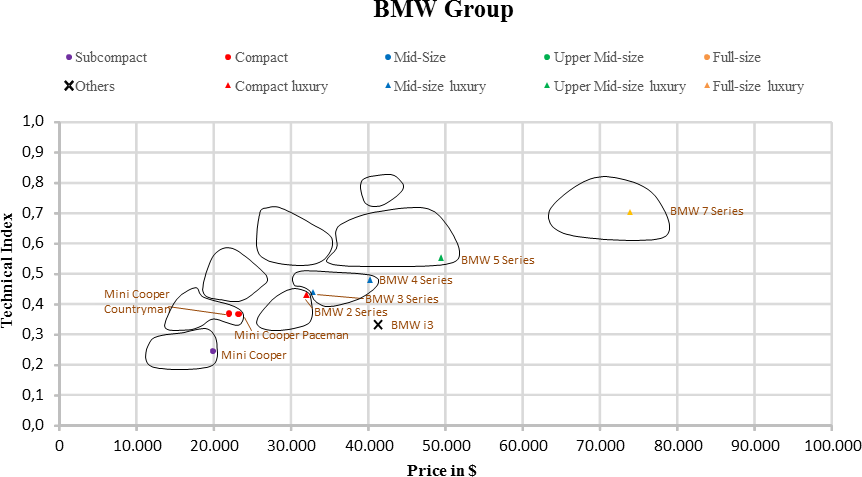

BMW Group

The BMW Group has already two interesting overlaps. First, the BMW 2 series and 3 series. For almost the same price, you can upgrade your two-door BMW 2 to a four-door BMW 3. As with any cannibalization, some customers may strongly prefer one over the other, while others could pick either one.

The second cannibalization is even more pronounced: the Mini Cooper Countryman and the Mini Cooper Paceman. They have nearly the same specs, nearly the same price, and a very similar styling. The only difference is that the Countryman has four doors, whereas the Paceman has only two. Unsurprisingly, most customers opt to get four doors for the price of two.

Volkswagen Group

Even before the Dieselgate, Volkswagen was a weak brand on the US market. An average VW model sold only 72,000 times in a year, which is less than any other large maker. Generally, they manage to keep their volume brand, Volkswagen, and their premium brand, Audi, separate – except for the VW CC and the Audi A4. For some reasons, the VW CC is rather expensive. For only a little bit more money, you get a premium A4. Again, unsurprisingly, most customers choose the (almost) free upgrade.

For being the second largest car maker, it is also surprising what they do NOT offer. There is no VW brand model available above the Passat or CC. The upper-mid-size and the full-size vehicle categories are not covered at all. Hence, there are no options within the VW brand for people who want a large car but can’t afford an Audi. Quite a gap in my opinion. But then, after the Dieslgate, VW probably has other problems to take care of instead of fixing their market strategy.

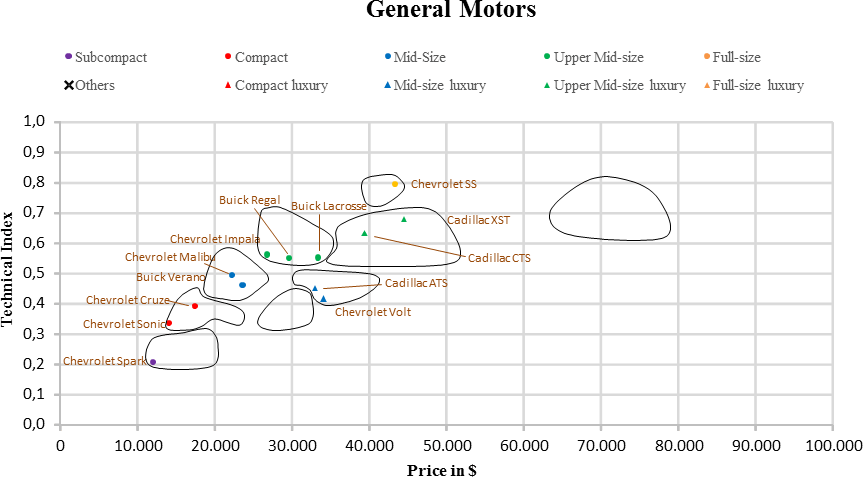

General Motors

GM has the largest market share of the US market with almost 18%. Yet, even though it manages to keep its premium-brand, Cadillac, separate in the luxury segment, it has no offers in both the compact luxury and the full-size luxury segments.

Additionally, there are three very similar cars in the upper-mid-size segment: the Buick Regal, the Buick LaCrosse, and the Chevrolet Impala. These cars are based on the same platform and have similar performance. The only small distinction is the price. Two of them even appear under the same brand. There is a risk of cannibalization among these three vehicles.

There is a second, even more significant cannibalization: the Buick Verano and Chevrolet Malibu. They have very similar technical specs and also very similar prices. Again, there may be a high risk of cannibalization in the mid-size segment of GM.

Overall, GM has a rather crowded strategy, while missing the most profitable full-size luxury segment. But then, they were rather occupied lately with their ignition key scandal (see also my post Culture of Quality – A Comparison of Toyota and GM Recalls).

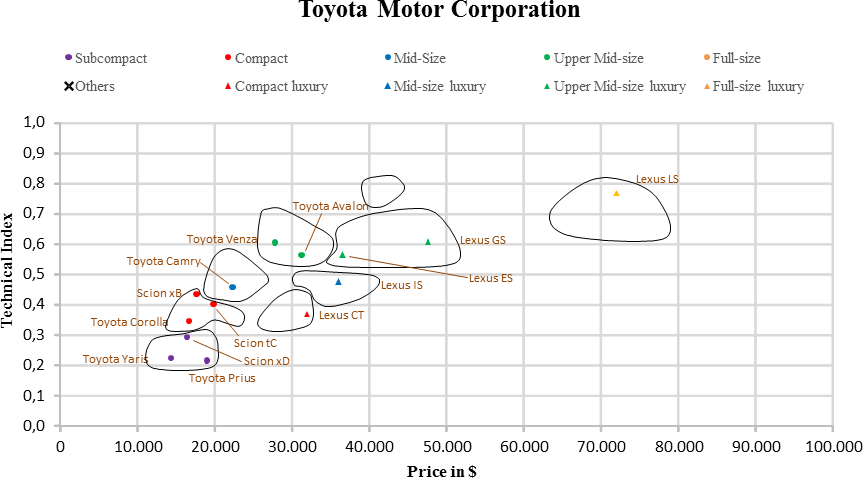

The Benchmark (again): Toyota Motor

Toyota has more models on the US market than any other maker, a total of 14. You would expect that they step quite a lot on each others toes, but no. A detailed look at their product placement strategy shows a near perfect result. None of the models are anywhere close to another from Toyota. The premium segment is entirely covered by their premium brand, Lexus. The volume segment is also covered by their volume brand, Toyota, except for the small full-size volume segment. A third brand, Scion, is aimed primarily at younger customers.

This strategy pays off for Toyota. An average-volume model sold 180,000 vehicles per year, more than any other maker. The luxury models also sold well with an average 30,000 vehicles per model and year. This is second only to BMW with 31,000 units.

Summary

It is clearly visible which companies put effort in their product-placement strategy (Toyota), and which ones not so much. While generally a new model is aimed to take away share from the competitor, many models instead cannibalize their own maker’s share. The above analysis is based on the US car market, but a similar analysis can also be done for almost any market. You know your own products better than anyone else, and hopefully also have a good understanding of your market. Does your company cannibalize itself? Is there a major segment you missed? If so, can you work on fixing these oversights? It helps you to organize your industry!

Sources

Amir Javanshir: Produktbezogene Marktsegmentierung des US-amerikanischen Automobilmarkts und anschließende Untersuchung der Firmenstrategien, Masters Thesis, Karlsruhe University of Applied Science, March 2015

Javanshir, Amir, and Christoph Roser. “Produktsegmentierung Des Amerikanischen Automobilmarktes – Kannibalisierung und Fehlende Strategien.” Sonderdruck Arbeitskreis Automobilwirtschaft, 2016.

Discover more from AllAboutLean.com

Subscribe to get the latest posts sent to your email.

Very interesting. But i would like to know more about the technical index, i couldn’t quite understand about it, if you could explain better

Hello Felipe, I expanded the description above to include more details in the tech index. Does this make it more clear?

Nice Job! I appreciate this useful study. But, Would you please explain more about clustering technique?

Did you cluster cars based on price and technical index, simultaneously?

what was your software?

Hello Mr. Hashemi, thank you for your interest in our study.

The segmentation process was done in several steps:

1. Excluding cars of the following class classifications: SUVs, microcars, sports cars, utility vehicles and vans.

2. Data collection of all remaining cars. Some car features e.g.: engine power, length, weight….

3. Correlation analysis of all features in order to eliminate “double features”. E.g. wheelbase and length correlated highly so that we took out wheelbase.

4. Putting all features on an index from 0 to 1.

5. Summary of all technical indexes to one tech-index.

6. Inserting that data tech-indexes and the prices of each car to statistical software “IBM SPSS Statistics”

7. Clustering all cars into segments by using the above mentioned software.

That was a very short summary of the segmentation process. I am aware that you need more detailed information in order to understand it totally but I hope you have now a rough idea about the segmentation.

Hi Amir

comprehensive explanation!

So, What was your clustering method via SPSS?

Two steps, Kmeans, Kohenen, …?

thanks

Hello Mr. Hashemi,

I used the clustering method “linkage between groups”.

If you have more questions please let me know.

Amir Javanshir

Hello Christoph!

Yes, it does

Thank you very much for the help

Kind Regards